- SET UP MANUAL PAYROLL IN QUICKBOOKS DESKTOP SOFTWARE

- SET UP MANUAL PAYROLL IN QUICKBOOKS DESKTOP PLUS

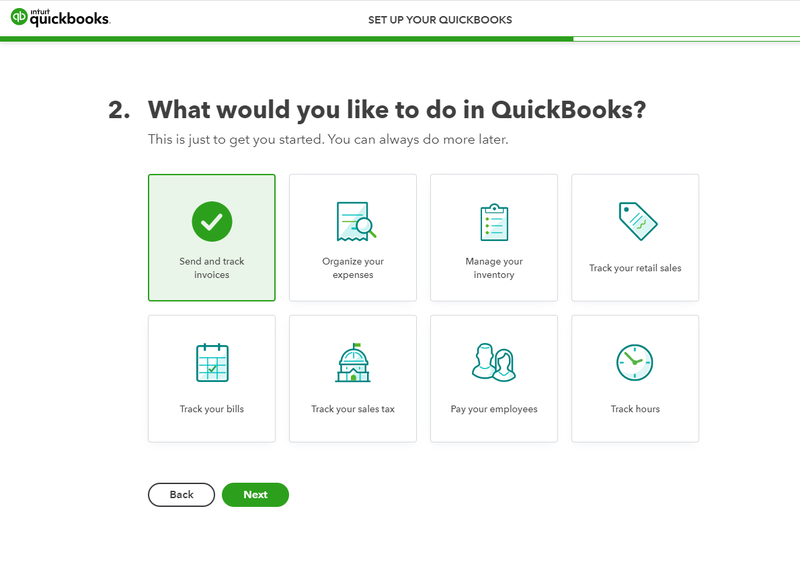

The function comes in handy when billing multiple clients for the same service.

This also allows users to send separate bills to customers or in large batches. Then the invoices can be electronically sent to customers via email.

SET UP MANUAL PAYROLL IN QUICKBOOKS DESKTOP SOFTWARE

Quickbooks is one of the most popular and widely used accounting software mostly used by freelancers, small business owners, bookkeepers, accountants, finance officers, and solopreneurs. Thus, accounting plays a crucial role not only in operating a business but also in meeting statutory compliance and developing future financial projections.

SET UP MANUAL PAYROLL IN QUICKBOOKS DESKTOP PLUS

O’Reilly members experience live online training, plus books, videos, and digital content from nearly 200 publishers.There are several economic decisions that must be taken by every business management on a day-to-day basis using accounting information recorded in financial statements. Get QuickBooks 2014: The Missing Manual now with the O’Reilly learning platform. This chapter uses Intuit’s desktop payroll service, as an. This chapter takes you through every payroll step, from the initial setup to running a payroll, printing checks, and remitting payroll taxes and returns to the appropriate government agencies. Either way, the Payroll Setup interview keeps track of what you’ve done and what you still have to do. You can walk through each step on your own or use an interview feature. Or you can compromise somewhere in the middle.Īfter you choose a payroll service, your next task is to set up everything QuickBooks needs to calculate payroll amounts. At the other end of the spectrum, you can opt for Intuit’s full-service payroll. To keep expenses low, you can choose a bare-bones service that provides only updated tax tables. If you decide to process payroll in QuickBooks, you first have to sign up for one of the payroll services that Intuit offers. When that time comes, you face the daunting task of dealing with payroll, which is the name for all the financial records you have to keep for employees’ salaries, wages, bonuses, withholdings, and deductions. Unless you run an all-volunteer operation, sooner or later, your employees are going to want to get paid. But if your company is like most, you’ll eventually hire people to help you with all those tasks.

When you first start your business, you may be the proud owner of every job title in your company: receptionist, sales rep, technician, bookkeeper, janitor, and CEO.

0 kommentar(er)

0 kommentar(er)